Ravi Batra on Greenspan Economics

I just heard Ravi Batra on Thom Hartmann's show. His 2005 book "Greenspan's Fraud," which I'd never heard of until now, sounds like a good source for an explanations what's going on in the finanacial markets. (Hartmann's review of the book is here, on Buzzflash.) I searched and found this old interview from Southern Methodist University, where Batra is a professor of economics.

Q&A With Ravi Batra

SMU expert talks about Greenspan's Fraud

Additional background: Greenspan's Fraud by Ravi Batra Greenspan timeline People are talking: Reviews About Ravi Batra You are highly critical of Greenspan and yet the general impression of Greenspan throughout his career has been generally positive. How has he managed to maintain a golden image for two decades?

After becoming Fed chairman Greenspan deftly handled several economic crises, including the 1987 stock market crash, the Mexican crisis of 1995, the Asian crisis of 1997, and the Russian default crisis of 1998. He applied the same remedy to each case—a grant of IMF loans to the afflicted countries. But people forgot that most of these crises were created by his own monetary and trade policies. In any case, his remedy failed to avert the global stock-market crash of 2000-2001 that started before the 9/11 massacre. Still, investors fondly remember Greenspan for staying calm in turbulent times.

Why do you think Greenspan was under-qualified for his position as chairman of the Federal Reserve and how did he overcome his shortcomings to get the job?

Greenspan had no banking experience when he became Fed chairman. He was not an accomplished economist either. But he did have a lot of influential friends in the White House. In 1974, he became the chairman of the Council of Economic Advisers with incomplete knowledge of economics, because he did not even have a Ph.D. at the time. But once in government, he came to know many well-known politicians who made a case for his eventual appointment as the Fed chairman.

What is the most serious charge you make against Greenspan?

He helped raise the payroll tax in 1983 in order to cut the Reagan budget deficit but sold his plan to the public as Social Security reform. No wonder there is no cash in the Social Security Trust Fund today. In the process he generated a regressive tax system which was copied around the world, and which eventually lowered GDP growth in the United States and sharply raised unemployment in Western Europe, including Germany, France and Italy.

What new evidence did you find to make this claim?

There is a lot of new evidence summarized in Table 2.1 of Chapter 2 in Greenspan’s Fraud: How Two Decades of His Policies Have Undermined the Global Economy.

You say our standard of living is lower than it was before Greenspan’s tenure, and yet he has convinced most people of the opposite. How can this be the case?

Greenspan’s measure of the living standard is real per-capita GDP or income. But this is an average figure, which aggregates the enormous incomes of a small minority of people with the meager ones of working Americans. The truth is that the purchasing power of the wages of production workers, who are as much as 80 percent of the workforce, has declined in the Greenspan era, which starts from 1981, when the income tax rate was reduced sharply.

Why do you think Greenspan is partly to blame for the market euphoria of the 1990s that led to recession?

Greenspan’s fault was his poor understanding of economics. He thought that the productivity jump resulting from the adoption of information technology generated high profits, which lubricate stock markets. But he forgot that when wages fail to keep pace with productivity, then the economy needs explosive debt growth to maintain profit growth. But debt growth cannot increase forever; so a stock market crash was inevitable. That is why all speculative bubbles pop in the end.

What are Greenspan’s motives in supporting Bush’s current proposed reforms of Social Security and how can we expect this major news story to unfold?

He wants to stay on as the Fed’s interim chairman, which all depends on President Bush.

Why would Greenspan create policies that are preferable to big business at the expense of the average citizen and how has he done so?

Greenspan realized early on that keeping Wall Street happy was the key to a Fed chairman’s long tenure. So he did whatever was necessary to please his constituency of big business, and in turn, was rewarded with several reappointments, even when politicians were unhappy with his policies. He even protected the profits of big speculators from their own mistakes by bailing out the crisis-prone countries. His policy of financial deregulation led to the deindustrialization of America. This, in turn, hurt the real wages of the vast majority of working Americans and generated the mushrooming trade deficit. By now things are so bad that the country needs a world subsidy of $2 billion per day to stay afloat.

Think about that for a moment. $2 billion a day. That's about $700 billion a year. And that was 2 years ago—I can't even imagine how much it must be by now.

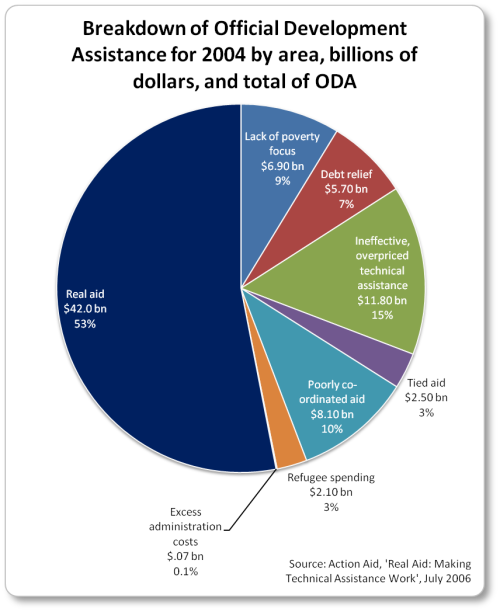

How much do we spend on foreign aid? Latest estimate I could find was about $80 billion a year in 2004, of which about half was "phantom aid" which didn't really help. So, consider. The net result is that the nations of the world have been financing US follies at home and around the world. At least until now.

Then consider one of those follies—the war in Iraq. It's pretty obvious that one of the main geopolitical reasons for this "war on terror" is to rein in China, by establishing bases near it and controlling its access to oil.

As a result of nearly everything in WalMart being built in China, I've heard that China holds $1.3 trillion in US dollars. Until now all China could do with these dollars is buy US treasuries. How long do you think China will continue to fund US attempts to threaten it?

Ok. On with the interview:

What policy reforms do you recommend that would be more protective of the interests of the average citizen?

In Greenspan’s Fraud I have shown that GDP and employment growth were much higher during the 1950s and the 1960s than between 1981 to 2004.We disregard the 1970s which were distorted by giant oil prices. My recommendation is that we go back to the policies that worked wonders in those earlier decades. These policies called for high income and corporate tax rates, a high minimum wage, but low Social Security tax rates. Creating a surplus in the Social Security Trust Fund through giant payroll taxes was a Greenspan-devised ponzi scheme that worked perfectly for its covert purpose, which was to preserve the pro-wealthy Reagan tax cuts and, subsequently, the Bush tax cuts.

What do you think will happen when Greenspan steps down in 2006 and how should investors prepare?

I am not sure if he will step down in 2006, because if President Bush fails to appoint anyone else as Fed chairman then Greenspan can legally stay on as an interim chairman until 2008. Currently, Greenspan is busy supporting Bush’s ventures to curry favor with the president. This has been the chairman’s modus operandi all along, namely to court those who are crucial to his position as the head of the Fed.

If Greenspan indeed steps down, it will turn out to be a non-event. The stock markets will remain sluggish for the entire decade, unless Greenomics is abandoned and new reforms are introduced.

What might we expect from a new Fed chairman and how could that change our current economy?

He or she is likely to be a Greenspan clone, because the maestro represents a consensus view of popular economics.

Labels: Alan Greenspan, China, Economy, Ravi Batra

2 Comments:

You might want to check out the latest story on Ravi Batra's latest book, which correctly pegged the current economic crisis.

http://www.fwweekly.com/content.asp?article=7369

The fascinating story includes some detailed criticism of the current bailouts and a prescription for fixing the mess the U.S. is in.

Who knows where to download XRumer 5.0 Palladium?

Help, please. All recommend this program to effectively advertise on the Internet, this is the best program!

Post a Comment

<< Home