Honest, You Won't Believe How Bankrupt the US is. You Won't. Really.

Federal Reserve Bank of St. Louis Review, July/August 2006, 88(4), pp. 235-49. (a PDF)

Laurence J. Kotlikoff:

a professor of economics at Boston University and a research associate at the National Bureau of Economic Research.

[after an algebraic description of ways to express debt and value and such)

To summarize, countries can go bankrupt, but whether or not they are bankrupt or are going bankrupt can’t be discerned from their “debt” policies. “Debt” in economics, like distance and time in physics, is in the eyes (or mouth) of the beholder.Unfortunately, since Mr. Kotlikoff falls for the" Social Security must be fixed"straw man before lamblasting the Democrats for also making things worse, I don't know how reliable the rest of his testimony is.

[ . . . ]

The Gokhale and Smetters measure of the fiscal gap is a stunning $65.9 trillion! This figure is more than five times U.S. GDP and almost twice the size of national wealth.

[ . . . ]

How are the Bush administration and Congress planning to deal with the fiscal gap? The answer, apparently, is to make it worse by expanding discretionary spending while taking no direct steps to raise receipts. The costs of hurricanes Katrina and Rita could easily total $200 billion over the next few years. And the main goal of the President’s tax reform initiative will likely be to eliminate the alternative minimum tax. This administration’s concern with long-term fiscal policy is typified by the way it treated the Treasury’s original fiscal gap study. The study was completed in the late fall of 2002 and was slated to appear in the president’s 2003 budget to be released in early February 2003. But when Secretary O’Neill was ignominiously fired on December 6, 2002, the study was immediately censored. Indeed, Gokhale and Smetters were told within a few days of O’Neill’s firing that the study would not appear in the president’s budget. The timing of these events suggests the study itself may explain O’Neill’s ouster or at least the timing of his ouster. Publication of the study would, no doubt, have seriously jeopardized the passage of the administration’s Medicare drug benefit as well as its third tax cut."

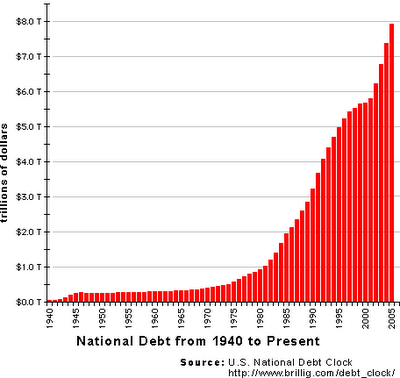

But this graph (from http://www.brillig.com/debt_clock/faq.html) tells all you really need to know:

2 Comments:

A little outdated--isn't the national debt over $9 trillion now?

the graph only goes to last year. I imagine we're way over a trillion since then...

Post a Comment

<< Home